Nuclear energy in 2023. Summary and trends for 2024

With an expert eye

Anna Pawłowska-Kawa, specialist in the field of ecological heating devices

Throughout the past year, discussions surrounding energy security, electricity and gas prices, and environmental concerns have dominated public discourse. However, among all sectors of the energy industry, nuclear energy emerged as the focal point of discussion. The year 2023, particularly its final quarter, witnessed a significant shift towards nuclear energy.

Insightful commentary for our summary was provided by Dr. Eng. Paweł Gajda, a lecturer at the Faculty of Energy and Fuels of AGH University of Science and Technology, specializing in nuclear energy.

The most important events in 2023 in the world

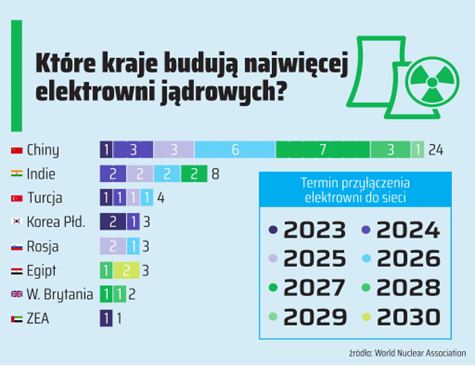

Which countries are currently building the most nuclear power plants?

The diagram illustrates the extent to which different countries are engaged in the development of nuclear technology within the energy sector. It encompasses power plants that were either under construction or connected to the grid in 2023, excluding projects that have been suspended.

Own study based on data from the World Nuclear Association

In a race to advance nuclear technology, China stands out as the clear frontrunner, significantly ahead of other nations. Last year, China led with the highest number of nuclear power plants either under construction or in advanced planning stages, including one that has already been operationalized and connected to the grid. This notable achievement belongs to the Shidaowan plant, situated in Shandong province, housing the world’s first fourth-generation reactor.

At the heart of Shidaowan’s innovation are two gas-cooled high-temperature pebble bed reactors (HTR-PM), each boasting a thermal power output of 250 MW. Together, they power a single 211 MW gas turbine. Chinese authorities assert that this technology epitomizes safety, even in worst-case scenarios where cooling capabilities are lost. The design ensures the prevention of core meltdown or radioactive leaks, while also promising greater efficiency and emission-free operation. The unit commenced operation in 2021, with commercial activities commencing in December 2023.

China’s ambitions extend far beyond this milestone. The nation aims to achieve a staggering 400 GW of nuclear power capacity by 2060, a figure nearly equivalent to the total nuclear power generated worldwide presently.

In addition to quantity, China prioritizes innovation. Physicist Peng Xianjue, known for his involvement in developing China’s hydrogen bomb in the 1960s, spearheads the design of the world’s first experimental thermonuclear reactor. The project, led by the China National Nuclear Corporation (CNNC), recently secured an agreement with Jiangxi Province government for constructing an experimental hybrid thermonuclear reactor, alongside strategic collaboration in uranium mining. This venture, estimated at around USD 2.7 billion, aims to enable continuous energy production of 100 MW. Its success would undoubtedly mark a significant milestone in the evolution of nuclear energy.

Following China in the global ranking is India, with plans to construct and connect eight new nuclear power plants to the grid by 2027, trailed by Turkey with four reactors and South Korea with three reactors in the pipeline.

NuScale project fiasco – will SMRs be created in the USA?

The United States had ambitious plans for small modular reactor (SMR) technology, particularly in Utah. However, unforeseen and unacceptable increases in investment costs, coupled with several cities withdrawing from energy collection agreements, led to a decision to halt the project. This setback had repercussions for NuScale, the company behind the reactors, with its shares plummeting by 20% following the announcement. Despite this setback, NuScale’s CEO, John Hopkins, affirmed the company’s commitment to other contracts in the US and abroad, including a project in Poland in collaboration with KGHM. Additionally, NuScale aims to pursue projects in Romania, Kazakhstan, and Ukraine. Regarding Ukraine, NuScale has pledged to develop even safer technology in anticipation of potential threats, such as a takeover of the power plant by Russian forces. However, the question remains whether Ukraine and other Eastern European countries will be financially capable of implementing such technology.

In contrast, France stands as the uncontested leader in nuclear energy production within Europe, with nearly 70% of its electricity stemming from nuclear sources. For more insights into the current state of nuclear energy in Europe, further details can be found here.

Does Germany already regret giving up nuclear energy?

The closure of Germany’s last nuclear power plant on April 15, 2023, was intended to be a crowning achievement of the country’s energy transition. However, a controversial decision ensued as a wind farm was dismantled to make way for expanding lignite mining in North Rhine-Westphalia, prioritizing energy security over ecology. Germany finds itself amidst both an energy and economic crisis, exacerbated by the absence of nuclear energy, which many politicians from CDU/CSU and FDP advocate reinstating.

Highlighted in a December 2023 report by “Frankfurter Allgemeine Zeitung” (FAZ), key politicians propose reintegrating recently shuttered reactors and accelerating the deployment of modern small modular reactor (SMR) technology. Bavarian Prime Minister Markus Soeder (CSU) stresses the urgency of fundamental political changes, especially in the energy sector. He advocates for immediate reactivation of existing reactors to alleviate the national crisis and expedited transition to more modern, smaller, and efficient reactors to ensure Germany’s competitiveness while meeting climate goals.

Experts interviewed by FAZ acknowledge that Germany’s energy transition is still in its early stages, with coal-fired power plants remaining operational and the absence of nuclear energy profoundly impacting the country’s situation. They also question the profitability of nuclear energy’s absence, pointing out the plans of many Eastern European countries like Poland, Romania, and the Czech Republic to build new nuclear power plants. This rhetorical query underscores the economic viability and strategic significance of nuclear energy for these nations.

COP28 summit and nuclear energy

A significant milestone in global nuclear energy was reached during the COP28 climate summit held in Dubai in November and December. French President Emmanuel Macron heralded the “great return of the atom,” prompting 22 countries, including Poland, to pledge to triple installed nuclear capacity by 2050. President Andrzej Duda, in attendance at the summit, affirmed Poland’s commitment to the declaration, emphasizing the importance of nuclear energy as a zero-emission source for future climate policy.

The most important events in 2023 in Poland

In Poland, significant progress in the field of nuclear energy was achieved in 2023, marked by concrete decisions and actions towards nuclear projects. Paweł Gajda highlighted the attainment of a positive environmental decision for the first power plant by Polish Nuclear Power Plants (Polskie Elektrownie Jądrowe) as a pivotal milestone. While some projects proposed unrealistic timelines, realistically, the first units may commence operation by the end of the first half of the 2030s, with the potential for multiple operational units by the end of the following decade.

A prominent development in Poland’s nuclear energy sector was the dispute between Korean KHNP and American Westinghouse, tasked with constructing two full-scale nuclear power plants along the Vistula River. Westinghouse is set to co-manage the construction of the first power plant for Polskie Elektrownie Jądrowe, with environmental and location decisions secured in September and October 2023, respectively. Fieldwork preparations commenced in December 2023, with detailed geological research expected in early 2024, paving the way for construction to begin. The infrastructure will house three AP1000 reactors with a total capacity of 3,750 MW, targeted to commence operation in 2033.

The second Polish nuclear power plant, a joint venture between PGE PAK Energia Jądrowa and Korean KHNP, also achieved a fundamental decision from the Minister of Climate and Environment, Anna Moskwa, in November 2023. This investment, located in Greater Poland Voivodeship in Konin-Pątnów, is anticipated to provide approximately 22 TWh of energy annually, accounting for around 12% of Poland’s current electricity demand, with commissioning slated for 2035.

What about Polish SMRs?

While progress in designing “large” nuclear power plants remains significant and largely unproblematic, the same cannot be said for Small Modular Reactors (SMRs), which were envisioned as optimal solutions in nuclear energy. Issues arose with the American company NuScale, as previously mentioned. When NuScale announced its withdrawal from the Utah project, Polish public opinion was informed that the company had also pulled out from constructing reactors in Poland, despite committing to the project in 2022 by signing an agreement with KGHM. However, NuScale promptly refuted these reports, stating that they had not terminated their contract with KGHM, and KGHM affirmed their continued plans regarding SMRs.

However, KGHM clarified that their plans were not solely dependent on NuScale, which was their preferred contractor but not their only option. KGHM’s application to the Ministry of Climate and Environment listed several potential technologies, including Voygr from NuScale, as well as options from Rolls-Royce, Nuward (EDF), SMR-160 (Holtec), and BWRX-300 (GE Hitachi), a newcomer to the list. Despite these reassurances and the Ministry’s issuance of a fundamental decision for SMR technology as part of KGHM Group’s activities in July 2023, doubts emerged regarding the project’s success and concerns arose about potential investor discouragement due to the encountered problems.

Visible trends in 2023

Nuclear energy, once considered taboo in many countries, is experiencing a renaissance. The concept of energy security has undergone significant transformation over the past year. While previously our concerns centered on energy prices and environmental impacts, the war in Ukraine and subsequent sanctions against Russia have highlighted the potential threat of significant energy deficits. This has prompted a swift resurgence in nuclear energy, with increasing declarations of new investments from various countries and companies. However, it will take time before this momentum translates into a construction trend.

The resurgence in nuclear energy extends beyond large-scale projects to include distributed nuclear energy. Support for such investments is evident, with 75% of residents in the communes of Choczewo, Gniewino, and Krokowa in Poland backing the construction of a nuclear power plant in their vicinity. Nationally, support for nuclear energy is equally promising, as indicated by surveys conducted by the Energy Regulatory Office. Paweł Gajda, a specialist in nuclear energy, attributes this surprisingly positive sentiment to a growing understanding of the safety of modern nuclear technologies, increasing awareness of climate change and energy transformation, and the pivotal role of nuclear energy in this transition. Additionally, the issue of energy security, particularly in light of recent crises such as the war in Ukraine, has significantly bolstered support for nuclear energy over the past two years.

Forecasts and challenges in 2024

In 2024, support for nuclear technologies is expected to increase, driven not only by shifting geopolitical dynamics but also by recent decisions from EU bodies. Notably, the European Parliament’s decision in November 2023 to classify nuclear energy as a green technology marks a significant milestone, aimed at further fostering its development.

Despite being viewed as a necessary evil for decades, nuclear power plants are now undergoing a renaissance, shedding their outdated or dangerous stigma. The world, including Europe, increasingly recognizes the need for stable, weather-independent, and safe energy generation technologies. While many countries prioritize renewable energy, there’s a growing acknowledgment of the importance of nuclear energy as well.

In Poland, fundamental decisions have been issued for two large nuclear power plants in Lubiatów and Pątnów. The question arises: should future investments prioritize additional large-scale power plants or small modular reactors (SMRs)? According to Paweł Gajda, considering these options as alternatives is misguided. Firstly, they are complementary, and secondly, they ignore the diverse range of nuclear technologies available, particularly in the context of SMRs. Furthermore, the success of an investment lies not only in what is built but also in how it is implemented, including factors like local content, technology transfer, and efficiency.

Gajda emphasizes the critical importance of addressing the challenge of securing appropriate staff for both investors and companies involved in supply chains. This challenge is multi-faceted and multi-level, requiring immediate action to educate and train personnel. Qualified specialists are needed not only for operating power plants but also for preparing investments, participating in administrative proceedings, and contributing to supply chains. A comprehensive, interdisciplinary approach to training specialists at various levels, including technicians, is essential. The quality of personnel will ultimately determine the efficiency and success of the nuclear program and its economic benefits.

Anna Pawłowska-Kawa

A graduate of the Kielce University of Technology, majoring in Management, Production Engineer, and Mechanics and Machine Construction. A specialist in the field of ecological heating devices. A supporter of a systemic and sustainable approach to the issue of energy transformation.